9,259 reads

Using Monte Carlo Simulation for Algorithmic Trading

Too Long; Didn't Read

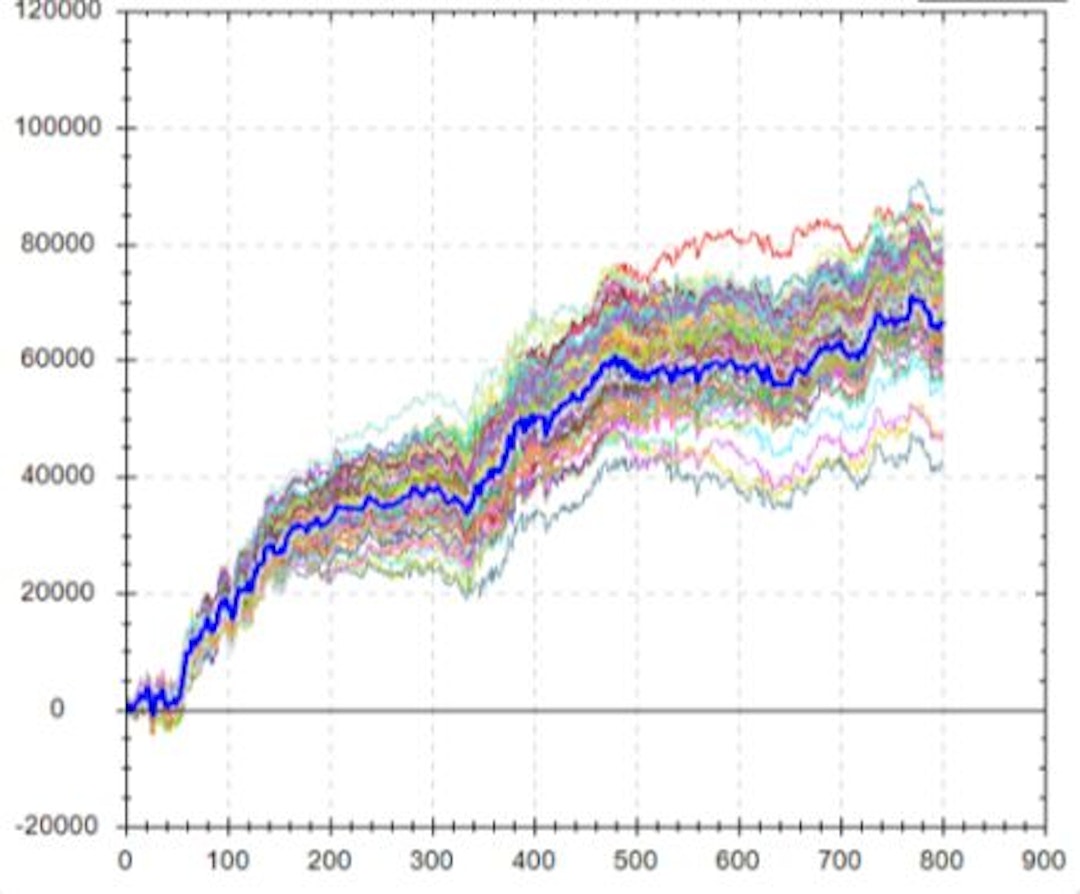

Monte Carlo Simulation is a statistical technique that injects randomness into a dataset to create probability distributions for better risk analysis and quantitative decision-making. Algo traders use Monte Carlo simulations to determine how much luck was involved in a strategy’s backtest and if future performance is likely to look like past performance. Monte Carlo Simulations help better simulate the unknown and are typically applied to problems that have uncertainty such as: trading, insurance, options pricing, games of chance, etc. The goal is to gain a better understanding of all the possible outcomes and potential minimum and maximum values a trading strategy can experience.Quantitative Trader and Developer. Founder of Build Alpha algo trading software

About @buildalpha

LEARN MORE ABOUT @BUILDALPHA'S

EXPERTISE AND PLACE ON THE INTERNET.

EXPERTISE AND PLACE ON THE INTERNET.

TOPICS

THIS ARTICLE WAS FEATURED IN...

L O A D I N G

. . . comments & more!

. . . comments & more!

Share Your Thoughts